Introduction:

In an increasingly digitized world, convenience is paramount, even when it comes to accessing cash. Traditional ATM transactions require a physical debit or credit card, but advancements in technology have introduced a game-changing innovation: cardless ATM access. With this revolutionary feature, individuals can withdraw cash from ATMs without the need for a physical card, offering unparalleled convenience and security. In this blog, we delve into the world of cardless ATM access, exploring its benefits, functionalities, and the impact it’s having on the way we bank.

The Emergence of Cardless ATM Access:

The concept of cardless ATM access first emerged as a response to the growing demand for seamless and secure banking experiences. Recognizing the limitations and vulnerabilities associated with physical cards, banks and financial institutions began exploring alternative methods to facilitate cash withdrawals. The result was the development of cardless ATM technology, which allows customers to initiate transactions using their smartphones, banking apps, or specialized codes instead of traditional cards.

Benefits of Cardless ATM Access:

Cardless ATM access offers a host of benefits for both consumers and financial institutions alike. For consumers, the primary advantage is convenience. By eliminating the need to carry physical cards, cardless ATM access streamlines the cash withdrawal process, saving time and reducing the risk of card theft or loss. Additionally, cardless transactions often come with enhanced security features such as biometric authentication, multi-factor authentication, and one-time PINs, providing added peace of mind for users. From the perspective of financial institutions, cardless ATM access helps reduce operational costs associated with card production and maintenance while enhancing customer satisfaction and loyalty.

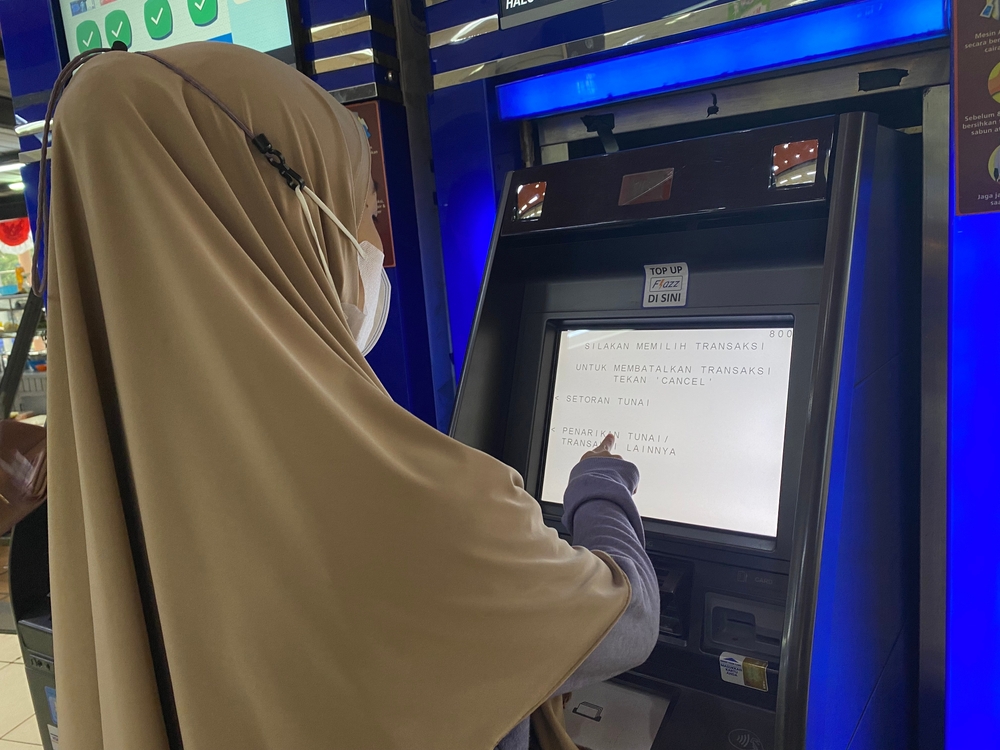

How Cardless ATM Access Works:

The mechanics of cardless ATM access vary depending on the technology and protocols implemented by individual banks and ATM networks. In most cases, customers can initiate a cardless transaction through their bank’s mobile app by selecting the cardless cash withdrawal option and specifying the amount they wish to withdraw. The app generates a unique transaction code or QR code, which the customer then enters or scans at the ATM to authenticate the transaction. Some cardless ATM systems also support near-field communication (NFC) technology, allowing users to tap their smartphones or wearable devices directly on the ATM to initiate the withdrawal process.

Security Considerations:

While cardless ATM access offers undeniable convenience, security remains a top priority for both consumers and financial institutions. To mitigate the risk of fraud and unauthorized access, banks employ advanced security measures such as encryption, tokenization, and biometric authentication. Additionally, many cardless ATM systems utilize dynamic authentication methods, such as one-time PINs or temporary transaction codes, which expire after a single use to prevent unauthorized access. Furthermore, customers are encouraged to take precautions such as securing their smartphones with biometric locks or strong passwords and avoiding sharing sensitive information with unauthorized parties.

The Future of Cardless ATM Access:

As technology continues to evolve and consumer preferences shift towards digital solutions, the future of cardless ATM access looks promising. With the advent of emerging technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT), cardless ATM systems are expected to become even more sophisticated, secure, and user-friendly. Moreover, the ongoing digitization of banking services and the proliferation of smartphones worldwide will drive the adoption of cardless ATM access on a global scale. Additionally, partnerships between banks, fintech companies, and ATM manufacturers will foster innovation and accelerate the development of next-generation cardless ATM solutions.

Social Impact and Inclusivity:

Beyond its practical benefits, cardless ATM access has the potential to promote financial inclusion and empower underserved communities. By reducing reliance on physical cards, which may be inaccessible to individuals without traditional banking relationships or identification documents, cardless ATM access opens up new avenues for accessing financial services. This innovation has particular relevance in regions where banking infrastructure is limited or where individuals face barriers to obtaining traditional bank accounts. Additionally, the convenience and security offered by cardless ATM access can help bridge the digital divide by providing marginalized populations with greater access to essential banking services. As cardless ATM access becomes more widespread, it has the power to enhance financial inclusion and empower individuals from all walks of life to participate in the modern economy.

Conclusion:

Cardless ATM access represents a significant milestone in the evolution of banking technology, offering unprecedented convenience, security, and flexibility for consumers. By leveraging the power of smartphones, biometric authentication, and advanced encryption techniques, cardless ATM systems are revolutionizing the way we access cash. As the technology continues to mature and gain widespread adoption, cardless ATM access is poised to become the new standard in banking, providing customers with a seamless and secure cash withdrawal experience anytime, anywhere.