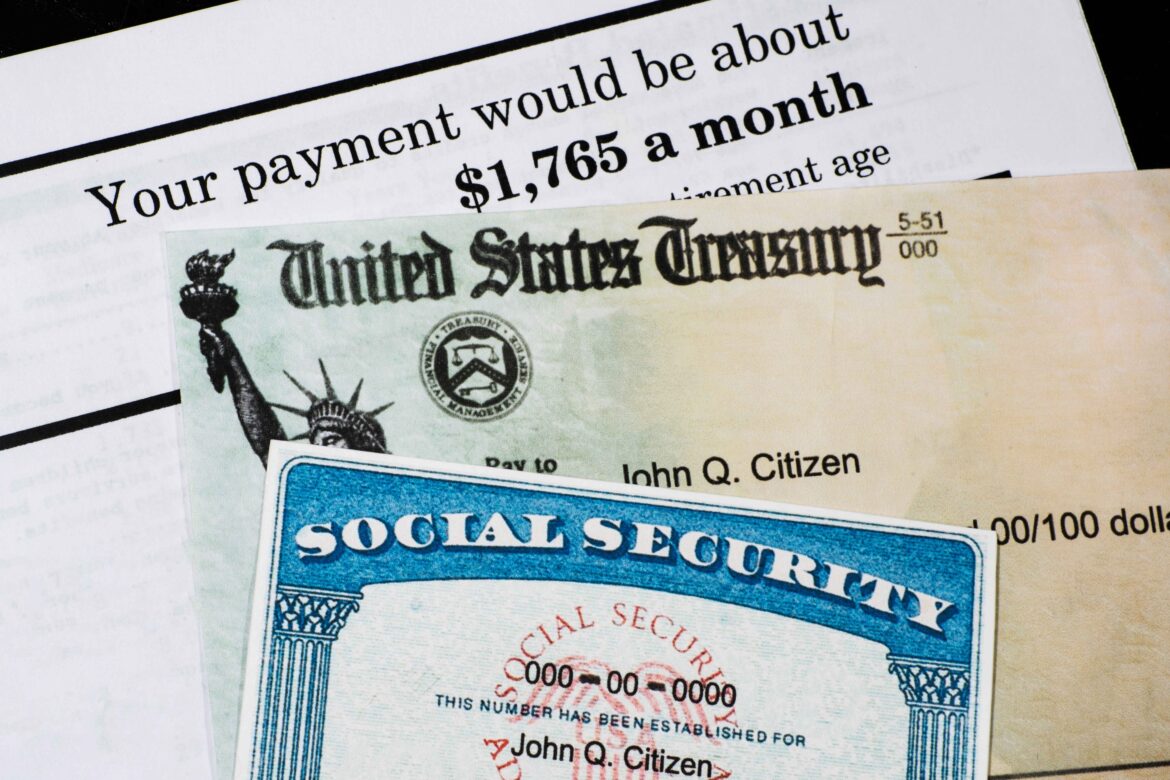

Social Security is a cornerstone of financial security for millions of Americans, especially during retirement. Understanding the rules surrounding Social Security benefits is essential for anyone planning their financial future. A significant update is set to take effect on January 1, 2025, and it’s important to understand how this change impacts the full retirement age (FRA).

What Is the Full Retirement Age (FRA)?

The full retirement age is the age at which individuals can claim their Social Security benefits without any reduction. You can start receiving benefits as early as age 62, but your monthly payments will be smaller. On the other hand, waiting until after your full retirement age (FRA) can boost your monthly payments.

Historically, the FRA has been gradually increasing. This change reflects longer life expectancies and aims to ensure the sustainability of Social Security funds. For decades, the FRA was 65, but it has gradually risen based on birth year, reaching 67 for individuals born in 1960 or later. However, new adjustments are now being implemented starting in 2025.

The New Full Retirement Age Starting January 1, 2025:

Beginning in 2025, the FRA will increase further. This adjustment is part of a larger effort to balance the financial pressures on the Social Security system while addressing the changing demographics of the U.S. population. The specific changes include:

- Incremental Increase in FRA: Individuals born in 1961 will see their FRA increase to 67 years and 6 months. For those born in subsequent years, the FRA will rise by two months for every birth year, eventually capping at 68 for individuals born in 1970 or later.

- Impact on Early Retirement: While early retirement at age 62 will remain an option, the penalty for claiming benefits early will become steeper as the FRA rises. For example, someone whose FRA is 68 but claims benefits at 62 will face a larger reduction in their monthly payments compared to someone whose FRA is 67.

- Delayed Retirement Credits: Individuals who delay claiming benefits past their FRA will continue to accrue delayed retirement credits, increasing their monthly benefits. This incentive encourages people to work longer and delay tapping into their Social Security benefits.

Why Is This Change Happening?

The increase in the FRA is not arbitrary. It’s driven by several factors:

- Longer Life Expectancy: Americans are living longer than previous generations, which means they spend more years receiving Social Security benefits. Adjusting the FRA helps align the system with these demographic changes.

- Financial Sustainability: The Social Security Trust Fund has been under financial strain for years. Raising the FRA is one way to reduce the financial burden and ensure the program’s longevity for future generations.

- Changing Workforce Dynamics: As people remain healthier for longer, many choose to work beyond traditional retirement ages. Raising the FRA reflects this societal shift.

How This Change Affects You:

The FRA increase impacts individuals differently based on their age, retirement goals, and financial plans. Let’s break it down:

For Those Nearing Retirement–

If you’re in your early 60s, it’s important to review your retirement strategy. The increase in FRA means you might need to work a bit longer to claim full benefits without reduction. Alternatively, you could still retire early but with adjusted expectations regarding monthly payments.

For Younger Generations–

Those born after 1961 have more time to plan for these changes. By understanding the new FRA now, younger workers can adjust their savings and investment strategies to ensure financial security in retirement.

For Current Retirees–

If you’re already receiving Social Security benefits, this change won’t affect you directly. However, understanding the shift can help you advise younger family members or friends who may be impacted.

Tips to Navigate the New FRA Changes:

To make the most of your Social Security benefits under the new rules, consider these actionable steps:

- Review Your Social Security Statement: Regularly check your statement to see how your benefits are projected to change based on your claiming age.

- Plan for Longevity: With people living longer, it’s wise to consider the long-term implications of claiming benefits early versus waiting until your FRA or beyond.

- Maximize Other Retirement Savings: Social Security alone might not cover all your needs. Bolster your retirement savings with 401(k) plans, IRAs, and other investment vehicles.

- Consult a Financial Advisor: A professional can help you navigate these changes and create a personalized plan that aligns with your goals.

- Stay Informed: Social Security rules are subject to change. Keeping up-to-date with the latest information ensures you’re making informed decisions.

Key Takeaways:

- The new FRA starting in 2025 will gradually rise to 68 for individuals born in 1970 or later.

- Claiming Social Security benefits early will result in larger reductions as the FRA increases.

- Delaying benefits beyond your FRA can boost monthly payments significantly.

- Planning ahead and understanding these changes are crucial for financial stability in retirement.

Wrap up:

The upcoming changes to Social Security’s full retirement age are part of a broader effort to adapt to evolving demographic and financial realities. While these adjustments may seem daunting, they also present an opportunity to reassess and refine your retirement strategy. Staying informed and planning ahead can help you handle changes with confidence and set yourself up for a secure, comfortable retirement.

Start planning today and make the most of the benefits available to you. Social Security remains a vital resource for retirees, and understanding these updates is key to maximizing its value for your future.