Introduction

In the dance of dollars and cents, money—a material symbol of value—becomes intertwined with the complex mechanisms of the human mind. The fascinating study of money psychology demonstrates the significant influence that our feelings have on our financial choices. This journey explores the emotional maze that underlies our financial decisions, from the delicate art of budgeting to the high-stakes world of investing. Through exposing the behavioral patterns that control our financial lives, we are able to understand how our relationship with wealth is shaped by the subtle interactions between our emotions. This helps us understand the complexities of the financial system and gives us the ability to make more thoughtful and informed decisions. Welcome to the fascinating world of financial intricacies, where the mind and money meet.

1. The Origins of Financial Behavior: A variety of psychological factors are at the heart of our financial decisions. Deciphering our attitudes toward money, which are influenced by our experiences, culture, and upbringing, is the first step towards understanding the complex web of financial behavior. Our financial psyche is greatly influenced by the narratives that society perpetuates around wealth and the money habits that are passed down through generations.

2. Cognitive Biases’ Effects: Cognitive biases are those subtly flawed reasoning patterns that permeate our financial system. These biases influence decisions about investments, spending patterns, and the process of making financial decisions overall. They range from confirmation bias, which occurs when we look for information that supports our preconceived notions, to loss aversion, which occurs when the fear of losing outweighs the joy of winning.

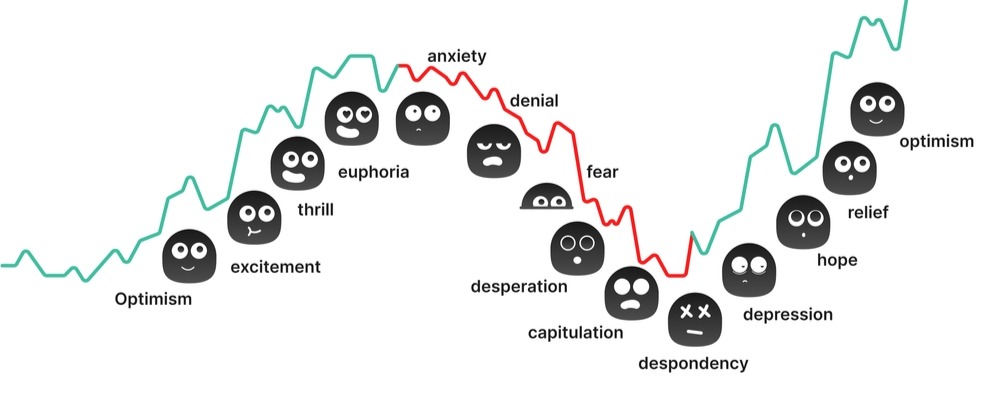

3. Emotional Rollercoaster of Market Volatility: The highs and lows of the financial markets reflect the emotional ups and downs of investors. It is essential to comprehend how greed, fear, and overconfidence influence market behavior in order to successfully navigate the uncertain world of investments. Making wise investment choices in the face of market volatility requires having a clear understanding of one’s emotional fortitude and risk tolerance.

4. The Budgeting Dilemma: Although making and following a budget is frequently recommended as a sensible financial tactic, there are substantial psychological obstacles. Even the most carefully constructed budget can be derailed by impulsive purchases, emotional spending, and the need for instant gratification. Creating a sustainable financial plan requires addressing the emotional triggers that drive spending habits.

5. The Weight of Financial Stress: Stress related to money is a common occurrence, and it has a significant negative psychological impact on people. Understanding and controlling the emotional load of financial stress is essential for general wellbeing, regardless of the source of the stress—whether it be the worry of debt, the fear of financial instability, or the pressure from society to attain a particular economic standing.

6. The Illusion of Lifestyle Inflation: The temptation to overindulge in one’s lifestyle grows with income. The psychology of lifestyle inflation emphasizes the ongoing balancing act between desires and financial prudence, whereby rising earnings lead to a corresponding rise in spending. Establishing long-term financial stability requires an understanding of this trend.

7. FOMO and Financial Decisions: People are influenced by FOMO to the extent that they make financial decisions based more on social comparisons than on their own financial objectives. Maintaining financial well-being requires an understanding of and mitigation of the impact of FOMO on financial decisions, whether it be through trendy asset investments or giving in to lifestyle pressures.

8. Financial Education and Behavioral Change: One of the most effective ways to break negative behavioral patterns is to arm oneself with financial knowledge. Financial education encourages people to make well-informed decisions by teaching them everything from the fundamentals of investing to how to create an efficient budget. This changes the psychological terrain of money management.

9. The Importance of Professional Guidance: When it comes to helping people navigate the complex web of financial decisions, financial advisors are invaluable. Their knowledge of the market is complemented by their comprehension of the psychological factors influencing the decisions made by their clients. Developing a cooperative relationship with a financial advisor can help you negotiate the emotional nuances of financial planning and offer insightful advice.

10. Fostering Financial Consciousness A transformative practice in the pursuit of financial well-being is developing mindfulness around money. People can cultivate a better relationship with money by making intentional and mindful financial decisions. A conscious awareness of one’s financial objectives, spending habits, and the emotional triggers that affect one’s financial decisions is fostered by mindfulness.

Conclusion

The psychology of money includes the standard the complex web of emotions that surrounds financial decision-making. The key to financial well-being is realizing the influence of cognitive biases, understanding the emotional fluctuations in market dynamics, and overcoming the psychological obstacles associated with budgeting. Through combining financial literacy with increased behavioral awareness, people are better equipped to navigate the complex world of finance. This trip fosters resilience and purpose beyond financial concerns. It enables a profound change in how we relate to money, transforming it from a source of stress to a useful tool for both financial and personal fulfillment. This all-encompassing method uses the psychology of money as a guide to a financially conscious and empowered life.