In today’s world, it’s easy to fall into the trap of consumerism. Everywhere we turn, there’s an ad or a promotion enticing us to buy something new, shiny, and exciting. But, all of these purchases add up and can quickly drain our bank accounts. This is where frugal living comes in. Frugal living is all about being intentional with your spending, cutting costs, and living within your means. And, the best part is, it doesn’t mean sacrificing your quality of life. Here are some tips on how to cut costs without sacrificing your quality of life.

Assess Your Expenses

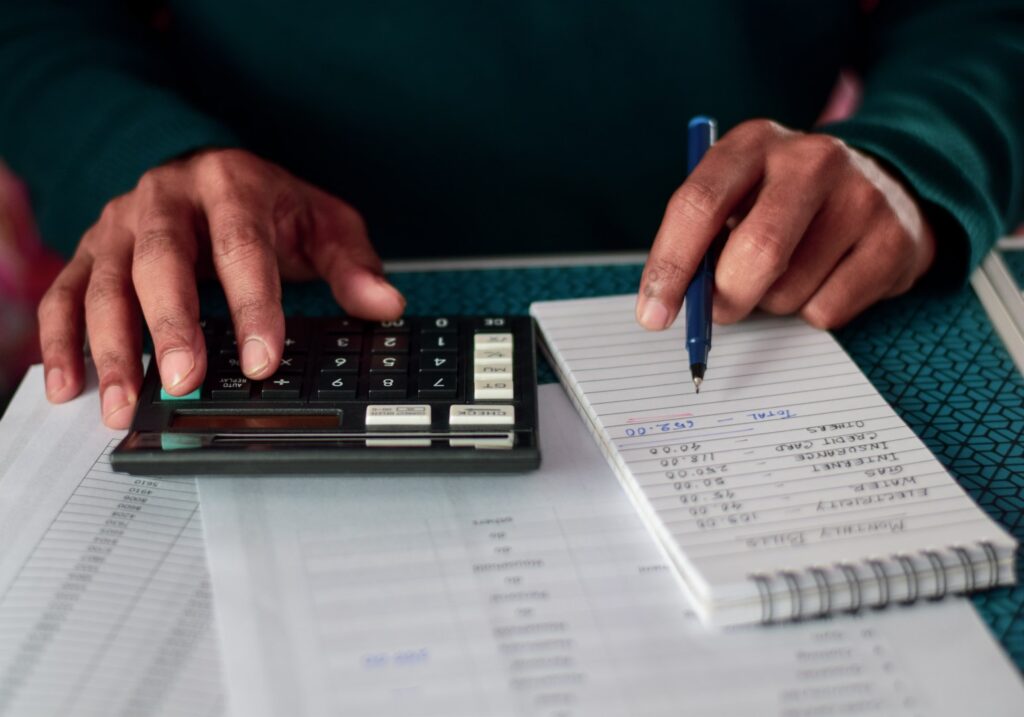

The first step to living frugally is to assess your expenses. This means taking a close look at your spending habits and identifying areas where you can cut back. Start by tracking your expenses for a month. This will give you a clear picture of where your money is going and where you can make changes. Look for areas where you’re overspending or areas where you can reduce your spending without sacrificing too much.

Cut the Cord

Cable TV can be expensive, and with so many streaming options available, it’s becoming less necessary. Consider cutting the cord and opting for a streaming service instead. Services like Netflix, Hulu, and Amazon Prime offer a wide selection of movies and TV shows at a fraction of the cost of cable TV. Plus, you can watch them on your own schedule, without having to worry about missing your favorite show.

Cook at Home

Eating out can be a huge expense, and it’s often unnecessary. Cooking at home is not only cheaper, but it’s also healthier and more satisfying. Start by planning your meals in advance and buying groceries accordingly. You can also make large batches of meals and freeze them for later, so you always have something on hand. And, don’t be afraid to get creative in the kitchen. There are plenty of delicious and easy recipes available online.

Shop Smart

When it comes to shopping, there are a few strategies you can use to save money. First, always shop with a list. This will help you avoid impulse buys and stick to the items you need. Second, shop around for the best prices. Use apps like Honey or Rakuten to find the best deals and discounts. Finally, consider buying in bulk. This can be especially helpful for non-perishable items like toilet paper or cleaning supplies.

Plan for Expenses

It’s a good idea to have a budget for everything you spend on. This will help you plan for your expenses and avoid overspending. You can use a budgeting app like Mint or You Need A Budget to keep track of your expenses.

When planning for expenses, be sure to include things like car maintenance, home repairs, and medical bills. These are expenses that can come up unexpectedly, and it’s important to be prepared for them.

Embrace the Outdoors

Entertainment can be a major expense, but it doesn’t have to be. There are plenty of free or low-cost activities you can enjoy outdoors. Take a hike, go for a bike ride, or have a picnic in the park. Not only will you save money, but you’ll also get some exercise and fresh air.

DIY

When it comes to home repairs or renovations, it can be tempting to hire a professional. However, this can be a major expense. Instead, consider doing it yourself. There are plenty of tutorials and resources available online that can help you with everything from painting to plumbing.

Not only will DIY save you money, but it can also be a rewarding and satisfying experience. In conclusion, frugal living doesn’t have to mean sacrificing your quality of life. By making a few small changes to your spending habits and focusing on the things that truly matter, you can live a fulfilling life while still achieving your financial goals. Remember to track your progress and celebrate your successes along the way – building good financial habits takes time, but the rewards are well worth it in the end.