Today, when the world is getting smaller all the time and everything—the larger environment—buttons of your house phone in hand! Whether you are an old hand in the investment game or just beginning to get a handle on your money, keeping abreast of these trends is essential. In this blog, we want to decipher highly technical economic terminology and understand how international financial movements change your wallet.

The Global Economic Landscape

In order to assess how global financial trends will affect personal finances, we must first get a grasp of the larger economic picture. The world economy is like a giant jigsaw, and each piece signifies the health of one country’s economic situation. The decisions of major players such as the United States, China, and the European Union have a decisive effect on global trends.

Interest Rates and Your Savings

Central banks play an important role in another global financial trend, interest rates. So when central banks raise interest rates, the effects reverberate throughout the financial system.

Tip for You: Watch for central bank announcements because changes in interest rates may affect your mortgage payments, credit card payments, and savings yields.

Inflation’s Sneaky Impact

The bad news is that inflation sneaks up on your buying ability. Inflation these days is more likely to be set off by global economic events, like supply-chain disruptions or commodity price fluctuations. For instance, if oil prices go up worldwide, it will increase the cost of transportation, which in turn raises the price on your neighborhood shelves.

Tip for You: Also, to the extent possible, diversify into things that have traditionally done well when inflation kicks in, like real estate or certain precious metals like gold.

Travel expenses and currency exchange rates

Currency exchange rates are also linked to global financial trends. When the currency of your country appreciates against others, it may help you travel abroad. On the other hand, a depreciated currency could also raise travel expenses. Exchange-rate breaks It makes sense to be on the alert for changes in exchange rates, especially if you’re gearing up for a trip abroad or considering overseas investments.

Tip for You: When you’re planning your trips abroad, try to arrange them at times when the exchange rate will be most beneficial.

Stock Market Roller Coaster

The condition of the stock market reflects that of the economy. Markets are changeable and can be unsettled by global events such as trade tensions or natural disasters. It would be best for people to resist the temptation to panic and organize their thinking from a long-term perspective. History shows that markets rebound, and patience is sometimes a good strategy.

Tip for You: Review your investment portfolio periodically and perhaps seek the advice of a financial planner to see if it still suits your long-term plans.

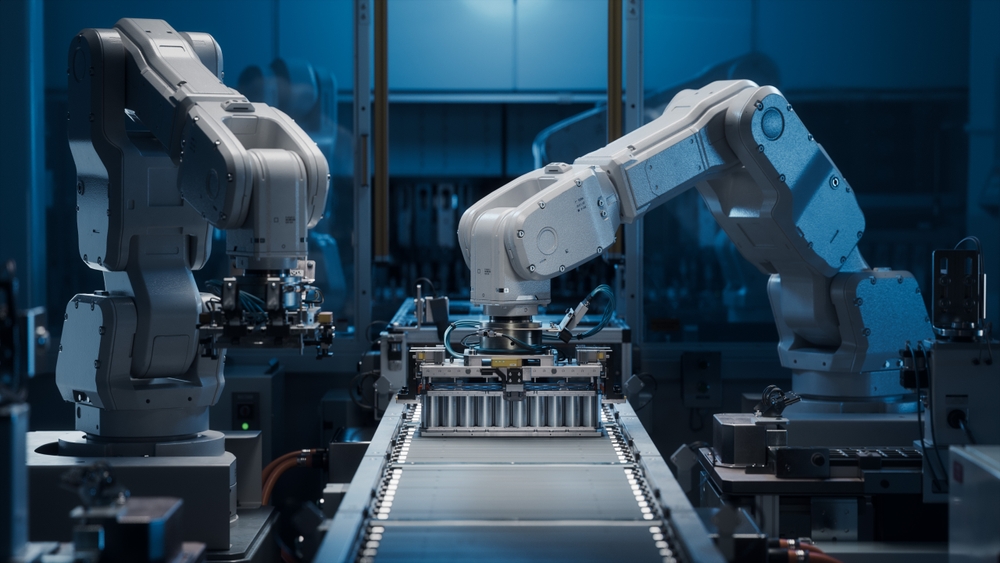

Technology’s Influence on Jobs

The rise of automation and technology is impacting industries and employment around the world. The problem is that technological breakthroughs arrive with negative as well as positive consequences. People may lose jobs and have to learn new skills. To ensure that you keep up with the changing job market, stay proactive about improving your skills.

Tip for You: Continuous learning and making opportunities to cultivate skills that suit new trends in the market are important investment concepts.

Conclusion

With this dance of world financial trends, one’s own finances are part and parcel. Understanding the linked nature of the global economic system will help you take measures to protect and enhance your financial health. Watch the interest rates, inflation rate, currency exchange relations, stock prices, and changes in technological trends—that’s one way to ride out the sways of an ever-moving financial ocean. But always keep in mind that knowledge is your best weapon on the road to sound finance.